Dainik Bhaskar's PAT up by 21.3% to Rs 99 crore in Q3 FY21

The group's advertising revenue stood at Rs. 291 million

Dainik Bhaskar, Divya Bhaskar, Divya Marathi and Saurashtra Samachar, today announced its financial results for the quarter ended December 31, 2020. The company has released an official communication, detailing its earnings in Q3FY21.

The circulation team’s continued efforts and focused strategies have enabled the Group in achieving currently around 90% of the pre-Covid circulation levels. We are witnessing continuous improvement in our circulation nos & expect to gain back most of the copies once normal market operations, including running of normal railways & bus services, are allowed.

Advertising revenues are reclaiming pre-Covid levels (YOY), and with the festive season providing a strong impetus, we have reached print business advertising at 87% of last year Qtr 3 with festival months of October and November together seen advertising revenue achievement of 95%.

The Print business EBITDA in Q3 FY2021 stood at Rs.1699 million (EBIDTA margin of 36.8%) as against Rs.1380 (EBIDTA Margin of 24.7%) million last year, which translated into an EBITDA margin expansion by almost 1200 basis points, underscoring the benefits of improved economic performance, soft newsprint prices & cost-cutting measures.

The consolidated revenue for Q3 FY2021 came in at Rs. 4966 million, which registered a growth of 42% compared to the previous quarter Dainik Bhaskar continues to set milestones of publishing ‘Mega Editions’ across its major markets like Sikar - 172 pages, Rajkot – 160 pages, Shimla – 144 pages, Bikaner - 130 pages, Indore – 128 pages, Ahmedabad - 80 pages, Raipur - 80 pages, Khandwa – 84 pages, Bhopal - 72 pages, Rewari - 78 pages, Jamshedpur – 76 pages, Ujjain - 60 pages, Hoshangabad - 60 pages, Jhunjhunu – 60 pages, Sagar - 60 pages, Bilaspur – 54 pages, which is a strong testament to not only the prowess of the Group but the fact that economic revival emanating from Tier-II & III cities/markets for Dainik Bhaskar Group are leading the growth trajectory of the overall economic revival which is also reflected in December’ 20 GST collection figures with Dainik Bhaskar Group Markets posting a stellar growth of 10% YOY which is higher than the growth for All India GST collection of 6.7% YOY.

While the sector has been witnessing changes even pre-Covid, the on-going pandemic has further strengthened two clear emerging trends. The first is - Print media continues to dominate the mind space of the reader when it comes to fact-based trustworthy & credible reporting, especially in an era where widespread fake news makes it difficult for a reader to discern.

This is also confirmed by the Ormax News Credibility Index 2020 in September, the Kantar Trust in News Study in November 2020 and the ASCI Trust Study in December 2020. The second is- The growth of the Indian Language newspapers that are showing great resilience in circulation and ad-revenues, on back of fast normalisation of Tier-II and Tier-III cities which are leading overall India’s economic growth. This is also confirmed by the EY Non-Metro Report in July 2020 This focus on the “un-Metro” cities is one of the legacies of the Dainik Bhaskar Group’s founder and it is fitting that Late Chairman, Shri Ramesh Chandra Agarwal’s rich legacy was honoured by Chief Ministers of 12 States and 4 Governors with the release of a ‘Special Commemorative Postal Stamp’.

Performance highlights for Q3 FY2021 Conso lidated [All Comparisons with Q3 FY2020

Advertising Revenue stood at Rs. 3667 million as against Rs. 4248 million

Circulation Revenue stood at Rs. 1082 million as against Rs. 1321 million

Total Revenue came in at Rs. 4966 million as against Rs. 6018 million

EBIDTA grew by 16% YOY at Rs. 1679 million 34 % margin) as against Rs. 1447 million (margin

of 24 af ter considering forex loss of Rs. 3.3 million

PAT grew by 21.3% YOY a t Rs. 990 million as against Rs . 816 million aft er considering forex loss of Rs. 3 million

Radio business:

Advertising R evenue at Rs. 291 million versus Rs. 372 million

EBIDTA stands at Rs. 108 million versus Rs. 135 million

PAT at Rs. 44 million versus profit of Rs. 62 million

Performance highlights for YTD 9M FY2021 Consolidated [All Comparisons with 9M FY2020]

Circulation Revenue stood at Rs. 3043 million as against Rs. 3921 million

Advertising Revenue stood at Rs. 7001 million as against Rs. 12338 million

Total Revenue came in at Rs. 10621 million as against Rs. 17465 million

EBIDTA stood at Rs. 2146 million as against Rs. 4249 million after considering forex gain of Rs.

6.6 million

PAT stood at Rs. 795 million as against Rs. 2509 million, after considering forex gain of Rs. 6.6

million

Radio Business:

Advertising Revenue at Rs. 553 million versus Rs. 1065 million last year

EBIDTA at Rs. 74 million versus Rs. 334 million

Net loss came in at Rs. 57 million versus Net profit of Rs. 164 million

Commenting on the performance for 9 Months FY 20 20 21, Mr Sudhir Agarwal, Managing Director, DB Corp Ltd said, Fiscal 2021 has undoubtedly been a challenging and difficult year for all of us. With the brightest minds in the world working together, they finally seem to be some light at the end of this long and arduous tunnel and hopefully, the widespread availability of the vaccine will help all of us get a semblance of normalcy back in our lives. The Print Industry undoubtedly dealt a severe blow by the pandemic and while the economy gets back on track slowly, Tier II and Tier III cities have not only bounced back stronger than most of the country but are leading the charge and have seen considerable improvement, especially in the festive season.

The pandemic has further strengthened the divide between India and Bharat when it comes to the Print Industry. Indian language newspapers are doing well not only in circulation numbers and pagination, but as advertisers turn their focus from the metros to smaller cities, advertising revenue is also set to see growth. For Dainik Bhaskar Group, the advertising revenues have seen a significant increase and our sustainable cost optimisation measures have given us permanent gains and this is reflected in improved operating performance. We are hopeful that this will set the pace for the forthcoming fiscal.

Read more news about Print Media, TV Media, Advertising India, Digital Media, Marketing

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook, Youtube, Whatsapp & Google News

Hindustan Times unveils election section on app

Readers can explore facts about India’s political heritage through various segments within the app

Readers can immerse in this enriching exploration of India’s political heritage – where history comes alive on the Hindustan Times Mobile App.

Hindustan Times has launched the "Elections Special", a section in its mobile application designed to help India uncover its political landscape from inception to the present.

The newly launched section in the mobile application allows readers to explore pivotal events, learn about influential leaders, discover transformative milestones, and delve into the evolution of Indian politics.

Readers can explore facts about India’s political heritage through various segments within the app.

The Hindu launches #SeeYouAtThePolls campaign ahead of elections

The aim of the campaign is to make Gen Z aware of their voting rights

The Hindu has launched a print campaign titled ‘See You At The Polls’ to target the Gen-Z culture and make them aware of their voting rights. The national daily believes that Gen-Z is not just the future; they are here and ready.

Elections are here and while everyone else is hitting the airwaves with preachy messages, The Hindu decided to shake things up a bit. They are immersing themselves in Gen Z culture with tongue-in-cheek communication that's sure to grab attention and get young India pumped up about voting.

As an extension of the campaign, to drive awareness, the publication has also launched ‘The Informed Voter Quiz’ in print. It will run till the polling is on in key markets. People can scan the QR code in print, participate in the quiz and take the pledge to vote.

They are also extending the campaign to digital platforms with immersive experiences like an Instagram AR filter for personalised and shareable experiences among youth, hosting a selfie contest on election day, and much more.

Bolstered by Ogilvy Bangalore, this campaign is currently operational across India and will come to an end when the elections are over. State-wise, the campaign will conclude in Tamil Nadu on April 19 and further run in Karnataka, Andhra, Telangana and more.

Their core message resonates with the belief that the younger generation is not only capable but also conscientious and actively involved, poised to exercise their right to vote. The publication has also taken a dig at run-of-the-mill campaigns that states the obvious- voting is your responsibility, go vote.

Suresh Balakrishna, Chief Revenue Officer of The Hindu Group said, “Election is an important milestone for Indian democracy. With campaigns like #DearMrPolitician and #UnderMyWatch, The Hindu has always used this space responsibly and come up with bold, hard hitting, edgy communication. This election, we decided to take an unconventional route. Rather than send out preachy messages on voting that will hit GenZ, we decided to celebrate them and their ability to make the right choices. This comes from our strong conviction that Gen Z are equally responsible and will certainly make their voices heard at the ballot box.”

Advertisers should realise that magazine readers have higher purchasing power: Anant Nath

Ahead of the Indian Magazine Congress, Anant Nath, Executive Publisher, Delhi Press and Editor, Caravan, discusses the challenges of the magazine industry and ways to keep it afloat

Once thriving on readers' pleasure of flipping through glossy pages, the magazine industry in India found itself navigating uncharted waters since the pandemic. From upheavals in distribution challenges to shifts in reader preferences, numerous challenges have compelled the industry to redefine its strategies to thrive in this new landscape.

Anant Nath, Executive Publisher, Delhi Press and Editor, Caravan India opines that the impact on magazines has been similar to that on the rest of the publishing industry, where readership has shifted from print to digital.

Even though most magazine publishers, like most newspaper publishers, have websites, everyone struggled to make revenue out of that audience in their own way.

The number of digital readers is more than the print audience because digital media is far more accessible and more easily consumable. But monetising that readership, especially from an advertising point of view, has been far more difficult, as per Nath.

Alternate revenue streams will flip the story for magazines

A major challenge for the industry is to figure out how to fix the physical distribution system. The physical newsstand distribution system has been adversely affected much before COVID.

“Subscription as an economy was much smaller in India as compared to magazine publishers in Europe and America. They were far more subscription-oriented. Indian magazine publishers were far more newsstand-oriented. But in the last four years, we have laid much greater emphasis on building subscriptions, which means putting in systems for better delivery of subscription copies,” he added.

The association has closely worked with India Post to roll out a new delivery service called Magazine Post. It has been extremely effective, reliable and as compared to private couriers, it is much cheaper.

Along with that, most publishers have been far more aggressive in marketing subscriptions through a mix of online subscription marketing campaigns, database cultivation, and various other ways.

Hence, Nath sees that the road ahead for most publishers is to keep on increasing the subscription play by improving the efficiency of delivery distribution and partnering with some e-commerce players.

“In the last year, we've partnered with Blinkit to create a widget within their app where consumers can order a copy. Similarly, now we're working with ONDC to create a magazine-specific, government-sponsored category so that all the ONDC-affiliated buyer apps like Paytm, Meesho and more have a magazine sale widget,” he added.

The association is also now working with India Post again to see how they can create new opportunities for selling subscriptions through the network of India Post.

Still, these methods may help the circulation and subscription revenue but magazines need to invent alternate revenue streams.

Nath shares that traditionally, while they have been monetising it through advertising and circulation subscriptions, events have also been added as a layer. What other possibilities can there be for monetisation?

He underlined, “There are revenue possibilities through partnerships with e-commerce, affiliate marketing, audio streaming and video streaming services by creating new content IPs. Now there are membership programs too with models where readers engage with the magazine editorial teams closely.”

Perception among marketers needs to change

When it comes to reviving ad revenue, the industry needs to change perceptions about advertising in magazines. Nath added, “We need to translate our efforts to a sellable story to our marketers whom we need to work within a much closer proximity to explain how the industry has built back its readership and its circulation numbers.”

Technically speaking, advertisers need to understand that magazines have been attracting a substantial readership willing to pay for the content and are far more important than somebody who is accessing content free of cost, without any investment, commitment or connection, like the digital audience or even the newspaper readership since the papers are quite cheap.

Nath highlighted, “A newspaper in India is priced at Rs 4 or 5 but a magazine is at Rs 60 to 100. So, a magazine reader is far more committed. We need to work with advertisers to say that this reader who has higher purchasing power, is far more engaged and trusts the magazine better is a better consumer for them.”

The more niche, the better

General interest content is being given a lot online; however, it's the niche magazine’s content that makes the difference. When the editorial team develops a certain expertise in the content, the readership gets more connected and is more involved since the content is closer to their interest.

Nath added, “That's where your digital content will take a backseat because ultimately a very committed group of editors, reporters and writers are creating extremely in-depth content and will stand out compared to content that is created in a very superficial and fast-paced manner.”

Magazines as a concept will have a much brighter future, believes Nath. “The more niche, more tightly defined your audience is, the more substantial will be the readership. Of course, you need a certain basic size of the audience. If the niche is just a few thousand people, your chances of finding readership in those thousand people will be limited. So your niche has to be right,” he concluded

India Magazine Congress to take place on May 3, 2024

The theme for the Congress this year is ‘Magazine Publishers Building New Revenue Streams’

The Association of Indian Magazines has announced the Indian Magazine Congress to be held on May 3, 2024 at the Taj Santacruz, Mumbai.

The theme for the Congress this year is ‘Magazine Publishers Building New Revenue Streams: How magazines in India are evolving new ways of building engaged reader communities, and monetising content and the audiences’.

An email from the AIM said, “Over the last few months, we at the AIM working committee- Srini, Manoj, Dhaval, Anurag, Riyad, Girish, and Rama Rao- have been putting together a program that touches upon the most pressing issues that magazine publishers have been facing in our road to recovery and ensuring our relevance for readers and advertisers alike. We all concurred that the biggest advantage that magazine brands continue to occupy in the clutter of the digital age, is our editorial robustness, authenticity and depth of content, and the ability to nurture engaged communities.”

Last year, IMC 2023 was therefore all about building engaged communities. This year, AIM wants to take the conversation ahead and talk about new paradigms for building new revenue streams given the industry’s core strengths.

Anant Nath, President, AIM shared, “I know these have been tough few years and there must have been times when each one of us would have gone through existential questions. But the more deeply I have thought about the underlying factors, as well as the evolving nature of digital space, I remain convinced that ‘magazine journalism’ as a conceptual framework, will continue to have relevance for readers as they crave authenticity, credibility, and most importantly, empathy from media brands. Magazine brands are uniquely poised for all that.”

He believes, while everyone evolves into new formats, adopt new technologies, if the magazine publishers remain wedded to the core values that inform their approach to content creation, they will have relevance.

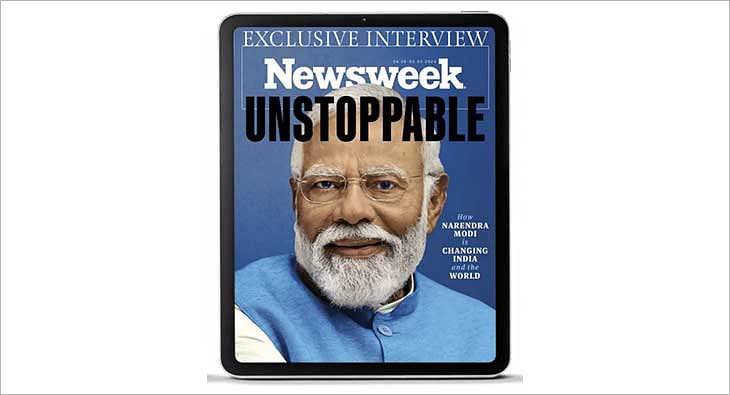

PM Modi featured on Newsweek cover

As per media reports, Narendra Modi is only the second Indian Prime Minister after Indira Gandhi to be featured on the cover of Newsweek

Prime Minister Narendra Modi has been featured in the latest edition of Newsweek.

In a 90-minute interview, he spoke about maintaining peaceful relations with China, and the urgent need to address the "prolonged situation" on the borders.

He talked about India's growth as a global economic power and how it is "a natural choice for those looking to diversify their supply chains".

As per media reports, Narendra Modi is only the second Indian Prime Minister after Indira Gandhi to be featured on the cover of Newsweek.

The Prime Minister also highlighted the government's efforts towards inclusive growth. He spoke about the people of Jammu and Kashmir taking part in the general elections, the revocation of Article 370 and other issues.

He expressed happiness on the sucesss of UPI and the initiatives taken under the Digital India campaign.

BW Businessworld focuses on growing spiritual tech economy in latest issue

The issue, part of BW Businessworld’s series on emerging sectors, delves deeper into the role that astrotech, numerology and faithtech play in opening up a Rs 8 lakh crore sector in India

BW Businessworld, a leading name in business journalism unveils its latest special issue as part of its ongoing series spotlighting emerging sectors. This edition focuses specifically on the burgeoning 'Spiritual Tech Economy' in India. It delves into an extraordinary sector where the ancient meets the avant-garde, offering insights into a market that preserves cultural heritage while paving the way for technological innovations.

The Growth Wave

The Spiritual Tech Economy, an emerging sector within the Indian economy, combines traditional spiritual services with cutting-edge technology, spanning astrology, faith tech, numerology and temple tourism. With a valuation of $58.6 billion in 2023, this market is expected to surpass $127 billion by 2031.

Astrotech Market

The issue highlights the significant growth of the astrotech market, which is anticipated to grow from $4 billion to $6.5 billion by 2025. This growth is indicative of a global trend, with the worldwide astrology market expected to expand from $12.8 billion in 2021 to $22.8 billion by 2031.

Highlighting the intersection of spirituality and technology, it also focuses on the potential of spiritual tourism in India, especially with the upcoming inauguration of the Ram Mandir in Ayodhya, which is set to boost the sector further.

Focus on Sustainability

In addition to exploring the spiritual tech economy, BW Businessworld's special issue also emphasises sustainability and recycling efforts. Featuring a section dedicated to leading companies in recycling and waste management, the issue celebrates the winners of the second edition of the Recycling for a Greener Tomorrow Awards, organised by BW Sustainability World.

BW Businessworld invites readers to engage with the content, offering a comprehensive look at the fusion of tradition and innovation in the spiritual tech economy and the ongoing efforts towards sustainability in business practices. This issue not only highlights lucrative growth opportunities but also underscores a commitment to preserving cultural heritage and promoting eco-friendly practices.

Caravan Hindi magazine to be launched in New Delhi on April 3

The magazine will be launched at the India International Centre

Caravan Hindi, a quarterly magazine, will be launched on April 3 at the India International Centre, New Delhi at 6 PM.

During the launch event, attendees can look forward to a thought-provoking panel discussion focusing on the State of Hindi Journalism. The panellists include Paresh Nath, Editor-in-Chief of Delhi Press; Seema Chishti, Editor of The Wire; Mrinal Pande, former Chief Editor of Hindustan; Sagar, Staff Writer of The Caravan; and Hartosh Singh Bal, Executive Editor of The Caravan.

The launch function is set to be a gathering of luminaries from the world of literature and journalism, all converging to celebrate this momentous occasion.

This launch marks an important moment in the magazine's journey, marking a new era of insightful journalism in Hindi by offering a fresh perspective on politics, culture, and society.

Share

Share