In Q1, Dish TV reports net loss of Rs 13.9 cr, subscription revenue up 5% Y-o-Y

Dish TV India Limited today reported its first quarter fiscal 2018 consolidated subscription revenues further stating that digitisation in rural areas could boost growth

Dish TV India Limited (Dish TV) today reported its first quarter fiscal 2018 consolidated subscription revenues of Rs. 6,917 million and operating revenue of Rs. 7,389 million. EBITDA for the quarter stood at Rs. 2,012 million. EBITDA margin was recorded at 27.2%. Net loss for the quarter was Rs. 139 million.

After the impact of demonetisation in the previous quarters the subscription revenue for the quarter grew 11.5% sequentially to close at Rs. 6,917 million and grew 5 per cent Y-o-Y. Average revenue per user (ARPU) grew 10.4% Q-o-Q and was recorded at Rs. 148.

Ramadan affects subscription growth and recharges

In the holy month of Ramadan when many Muslims opt away from television and other sources of entertainment, Dish TV felt a minor pinch. Ramadan during the last month of the first quarter moderated subscriber additions and recharges. Unlike fiscal 2017, this year the period of Ramadan fell completely in the first quarter as against a Q1-Q2 split last year. Involvement in the GST transition process during the last few days of the quarter also diluted some managerial attention towards the business.

Seasonality impacted the growth in advertisement and bandwidth revenues however, the company remains highly optimistic about the future growth potential of these two revenue line items.

Amalgamation of Videocon D2h into Dish TV

October 1, 2017 is scheduled to be the date when all the arrangements would be in place making Dish TV one of the world’s largest DTH platform. Jawahar Goel, Chairman and MD, Dish TV India, said, “The proposed amalgamation will further help create scale in the highly fragmented TV distribution landscape in India while creating significant synergies through the combination. Drawing inference from our initial estimates and integration meetings held so far, we expect approximate net synergies from the amalgamation to the tune of Rs. 1,800 million in FY18 and Rs. 5,100 million in FY19. Significant amongst these would be synergies arising from unified content contracts as each major contract becomes due for re-setting.”

GST and its implications

Dish TV states that businesses would also get benefitted by savings in administration, litigation as well as compliance costs that will result from a simpler tax regime.

Goel said, “Dish TV has successfully transitioned to the GST regime. The DTH industry has seen a reduction in the overall indirect tax rates under GST. Though benefits due to the unified tax may take some time to reflect in numbers, the sheer check on tax avoidance in the informal cable sector should be immediately helpful in reducing irrational competition from cable. The Harmonized System Nomenclature (HSN) codes, unit and rate which need to be separately declared in the invoice in value chain right from the broadcasters to the local cable operator, under GST will give a logical and systematic classification to goods and services thus reducing the possibility of misdeclaration by businesses. The total amount of GST to be collected and payable by Dish TV during the current quarter would be to the tune of Rs. 1,350 million.”

The May 2018 deadline for electrification of all villages and 15 August 2022 for electrification of all households could be a good news for the Pay-TV industry as electricity shortage has always had a negative impact on consumption of TV entertainment. With all households in the country getting electrified, Dish TV predicts a spike in growth.

Rural focus for growth

With more than 75% of its subscriber base outside urban areas, Dish TV has always been a rural heavy DTH business. Goel, said, “With digitisation spreading to rural India, our primary objective is to address the needs of pay-TV viewers in small towns and villages. For the first time in the history of DTH industry in India, indirect tax rates have been separately communicated to the consumers. In an attempt to make TV viewing affordable for viewers, Dish TV introduced the Rs. 160 per month (plus taxes) pack this month. In addition, by partly adopting TRAI’s new Tariff Order, Dish TV also started offering all channels, except Sports and select south channels, at affordable ala-carte prices of Rs. 8.50 and Rs.17.00 (plus taxes) per channel per month for SD and HD respectively. It would be worthwhile to mention here that none of these new offerings would be margin dilutive for our business.”

Read more news about Television Media, Digital Media, Advertising India, Marketing News, PR and Corporate Communication News

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube, Whatsapp & Google News

The current ratings system lacks trust: Rabindra Narayan, PTC Network

During the recently held e4m media debate, Rabindra Narayan, MD and President, PTC Network, spoke for the need for multiple TV rating providers

The current system of ratings by BARC lacks trust and credibility, said Rabindra Narayan, MD and President, PTC Network, at the e4m debate on Wednesday while asserting the need for multiple rating agencies in the broadcast ecosystem.

The e4m media debate on ‘India needs multiple TV rating providers because competition drives excellence’, held in New Delhi, was chaired by Anurag Batra, Founder of e4m and Editor-in-Chief of Businessworld Media Group.

During the debate, Narayan, who was speaking for the motion with other panellists, questioned the Broadcast Audience Research Council (BARC) ratings, particularly for news channels saying that politicians spending money to advertise on news channels and not GECs, is proof enough that the genre is doing much better than the ratings given by BARC.

“The fact that we are having this discussion, implies that the current system lacks trust. It lacks credibility. BARC analyses only linear TV that is beamed and received through satellite and cable. TV viewing today is not just linear TV, it also has several forms like connected TV and Fast TV coming on the same screen but BARC is not measuring it,” he said.

Narayan further said that it was time to innovate and look at content rating rather than just television rating points.

“As per BARC, news genre reach is 6-7% in the entire country, if that is true then why are politicians eager to spend on advertising on news channels? Why not on GECs? Why all the money spent by advertisers to reach maximum consumers, based on this Bible (BARC) which is junk? Why are we fighting for TV rating points and not content rating points when the technology and the system is changing?

“The current system of ratings (by BARC) is flawed, biased as it is controlled by a handful of people. Broadcaster lobby is controlled by four business houses so it will always remain in their favour. The data shows it,” he argued.

In his concluding remarks, Narayan said that BARC needs to improve and for that it does not even need to invest in more meters than it already has because cable operators and DTH are now digitised.

“They don’t even need to invest more. They don’t even need more meters than the ones installed already because every cable operator is now digitised and has two-way addressable communication available,” he said.

e4m Media Debate 2024: Call for multiple ratings agencies to break monopoly

Industry players discussed the authority of the current ratings system and whether having multiple agencies will cause increased complexities, discrepancies and expenses

Indian TV news media and advertisers today rely solely on the data released by the Broadcast Audience Research Council (BARC) India to strategise media plans and budgets.

Hence, many suggest having multiple rating systems which will allow for a more nuanced understanding of viewership patterns across different demographics.

Rabindra Narayan, MD and President, PTC Network; Mona Jain, Chief Revenue Officer, Zee Media, and Karthik Sharma, Group CEO, Omnicom Media Group believe a multi-ratings system will drive excellence amidst competition.

On the other hand, multiple ratings systems may also present challenges such as increased complexity, potential discrepancies in ratings, and higher costs for broadcasters as well as advertisers.

The current system of ratings is “flawed” and “biased, as it is controlled by a handful of people,” was the view of the industry veterans who advocated the need for multiple rating agencies instead of just one, which is currently the BARC, saying “monopoly makes people complacent”

During the debate, things got intense when some of the panellists, who were speaking for the motion, questioned BARC ratings, particularly for news channels saying that politicians spending money to advertise on news channels and not GECs, is proof enough that the genre is doing much better than the ratings given by BARC.

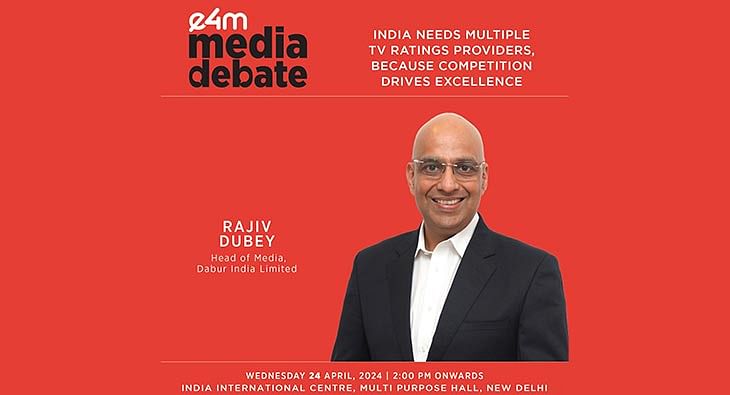

To present a viewpoint against the motion, Chintamani Rao, Strategic Marketing and Media Consultant, Rajiv Dubey, Head of Media, Dabur India, and Varun Kohli, Director and CEO, Bharat Express News Network joined the debate at e4m’s Media Debate in New Delhi. Dr. Annurag Batra, Chairman and Editor-in-Chief, BW Businessworld Media Group and Founder, e4m Group, chaired the debate.

Jain opened the discussion and said, “There is a dependency of an advertiser to take up a particular media plan via the agency. On the other hand, the broadcaster is absolutely at the mercy of the measurement system which decides where you rank. The issue is nobody looks at what the reality on ground is. Hence, I have started telling agencies and advertisers to also look at my digital platform’s ranking but the rating in BARC still holds significant value for them.”

She further suggested we should have an authenticated, validated, acknowledged currency which is recognised and valued by advertisers and agencies as well.

Presenting an opposing stand, Rao explained, “There many doubts about BARC and its functioning but I continue to maintain that audience measurement is no business of the government.”

At the end of the day, it is not about the number of vendors but how they are managed. Two poorly managed are not better than one, he added. The key issue is that BARC is dominated by one of its constituents and that is the one which is being measured.

“If advertiser’s money fuels the entire media ecosystem, why did they accept a structure with Indian Broadcasting & Digital Foundation (IBDF) at 60 percent?” questioned Rao.

Sharma, who joined virtually, expressed that if we forget the industry for a while, why do we need the NSE and BSE? Why do we need CIBIL and Experian? The short answer is innovation and competition. If there would be no competition, we would have one brand in every category we operate in.

“Even in a market like the USA, which has the largest AdEx market, there are two systems. Even the UK, Australia, Malaysia, Philippines and so many more countries have two audience measurement systems. In a largely populated country like India two systems will help in better sampling and segmentation,” he added.

Dubey took the stage right after and spoke about how one, two or multiple rating systems don’t matter to an advertiser. At the end of the day, it should help the brand sell. His objective is to reach out to the consumers in the cheapest possible manner.

“The idea of BARC was to have a robust system which could measure everyone well. Have we been able to do that? Probably yes or probably no,” he said.

With changing times, the audience needs have changed and NCCS was a system that measured the class of people based on the ownership of consumer durables. But now, the newly proposed ISEC fulfils those gaps.

Consumers have also started consuming content on different platforms, more towards digital and OTT. Dubey believes, “We haven’t been able to measure that audience correctly yet. Hence, the Indian TV industry needs one system and that system needs to be strengthened in such a way that it measures TV and digital audience equally.”

On having multiple audience measurement systems, the Dabur spokesperson said, “To solve the problem, you should not create another problem, but fix the problem instead.”

Narayan of PTC, who stood for the motion, expressed, “The fact that we are standing here and debating the issue, implies the current system lacks trust and credibility. We are also setting the premise that by TV ratings, we only mean linear TV ratings because that is what BARC does.”

He further shared that BARC does measurement via image mapping and hence, when any channel puts its watermark on any platform, it should become measurable for BARC since they already have the technology for it.

“Then why don't they? Because they need more focus on analysis, not more investment. The trouble is the ecosystem is not allowing the expansion of those ratings,” he added.

Today, BARC says 9 out of 100 people watch PTC, which is impossible and advertisers bargain for the ad rates accordingly. The channel today continues to invest in good shows but advertiser interest is low due to BARC’s data. If there is any truth to this, why wouldn’t players like PTC fight for multiple ratings systems?

“When Chandrayaan was launched, everyone in the world and India was watching it but if you see the BARC data, that particular week the ratings of the news genre went down. Is that even possible? News genre is much higher than what BARC is projecting,” Jain added.

Even on a day like the launch of Chandrayan, there was no spike on BARC data. Jain and Narayan both believe the current system is flawed and biased because it is controlled by a handful of people.

“The fact that we are having this discussion, implies that the current system lacks trust. It lacks credibility. BARC analyses only linear tv that is beamed and received through satellite and cable. TV viewing today is not just linear tv, it also has several forms like connected TV and Fast TV coming on the same screen but BARC is not measuring it,” Narayan said.

Narayan further said that it was time to innovate and look at content rating rather than just television rating points.

“As per BARC, news genre reach is 6-7% in the entire country, if that is true then why are politicians eager to spend on advertising on news channels? Why not on GECs? Why all the money spent by advertisers to reach maximum consumers, based on this Bible (BARC) which is junk? Why are we fighting for TV rating points and not content rating points when the technology and the system is changing?

“The current system of ratings (by BARC) is flawed, biased as it is controlled by a handful of people. Broadcaster lobby is controlled by four business houses so it will always remain in their favour. The data shows it,” he argued.

Kohli of Bharat Express, said, “BARC came into existence because publishers wanted a different rating system and then a mechanism was conceived. Now, questioning that system just because ratings aren’t in the right proportion or it doesn’t map digital audiences and to further ask for a separate body, I dont think is the right way.”

The industry needs to come together and exercise jurisdiction with BARC to tell them what more is needed and where they can get better, he suggested as a solution.

Rao also suggested it is better to have an aggregator rather than multiple players. In that case, the aggregator can also become the provider of data. BARC can always collect multiple data from various sources and present it.

The mapping of the audience correctly will also solve the problem in a way, which will be done with ISEC majorly. Having a unified measurement is also another solution, said Dubey.

According to Sharma, “Having more than one player will definitely fuel innovation and have a little competition, which is good. Different rating systems could also focus on different target segments, cohorts and more.”

“We need to focus on screens and not linear tv or digital. It is a screen-based world and people are just consuming content which is meaningful for them. So different types of consumptions require different types of measurements. My argument is innovation is critical as it is high time.

“Consumer is looking at the screen through mobile or TV sets. How are we measuring it? Some competition is healthy. It is important to have a mindset of how one system can help the other. The current system is not wrong but the newer system can enhance what we have,” he said.

Narayan concluded, “Television viewing and consumption has changed. Either BARC grows up to the changing times or others should come in and fill the gap. The market forces will decide who will remain and who will go, whose data is authentic and whose is not. There is no need for a debate here.”

Share

Share