Will RBI ban impact Mastercard’s advertising?

Only to an extent, believe market experts, as they say that the brand is anyway not a big spender when it comes to media advertising

The Reserve Bank of India (RBI) recently banned Mastercard Asia/Pacific from onboarding new domestic customers. The decision, the central bank said, has been taken as the global card network failed to comply with data localisation rules. So will the restriction impact the advertising spends of the brand? Yes, to some extent, say market experts. However, they also add that the brand doesn't seem to be a big spender when it comes to media advertising.

As per market estimates, Mastercard spent Rs 80 crore on TV, print, radio, and digital advertising in 2018, whereas, in 2019, the total ad spend was around Rs 60-70 crore. In 2020, the company witnessed a massive dip in the total spend that declined to Rs 35 crore due to Covid-19.

According to a senior media planner, who spoke on the condition of anonymity, Mastercard is not big on advertising on media. Instead, they spend a huge amount on retail and partnerships. A lot of their investments go in partnership with banks and promoting directly via banks or other partners, which is a huge marketing investment for them.

So, though the company is not a very heavy spender on media, it has consistently invested in building the brand over the past 10 years. "Earlier the consumer only had two options, Mastercard or Visa, and most people accepted the card that their bank issued. But now consumers are getting more aware and are expressing preferences, and therefore, partnerships with banks and BTL promotions play a role," he shared.

Stressing on the same point, another industry expert explained, "Much of their interaction with consumers is intermediary communication. They invest largely in market influencers--partnerships with banks or financial technology companies. Therefore, advertising is not such a critical component of their brand. Market forces and co-branded marketing is more important for them.”

In September 2018, the company, to encourage digital payments in India, roped in cricketer Mahendra Singh Dhoni as its brand ambassador. Later in 2020, the brand also associated with CSK with a ‘Priceless Moments’ package that the combined TV (Star network HD feeds), Hotstar and TV-to-Mobile targeting app.

"Their brand ambassador might be a sports celebrity, but they do advertise on other properties that cater to a mass audience. They also roped in Irrfan Khan as its face a few years ago to boost the less-cash economy in India. They will still need to do some awareness advertising for their existing customers once they sort out things with RBI," said another media planner who too wished to remain anonymous.

Early this year, Mastercard and Razorpay launched a strategic partnership that combines Razorpay's payment processing capabilities with Mastercard's digital banking solutions and card services. The partnership empowered Indian micro, small and medium enterprises (MSMEs) to digitize their operations.

Meanwhile, in response to a mail sent by exchange4media for an official comment on the advertising aspect, Mastercard clarified that there will be no impact of RBI’s decision on India's current operations.

The official statement read, "Mastercard is fully committed to our legal and regulatory obligations in the markets we operate in. Since the issuance of the 2018 directive requiring on-soil storage of domestic payment transaction data, we have worked closely with the RBI to ensure that we comply with the requirements. While we are disappointed with the stance taken by the RBI, we will continue to work with them and provide any additional details needed to resolve their concerns. This is consistent with our considerable and continued investments in our customers and partners in India to advance the government's Digital India vision."

The RBI circular on the Storage of Payment System Data dated April 6, 2018, stated that all system providers were directed to ensure that within six months, the entire data (full end-to-end transaction details processed as part of the message/payment instruction) relating to payment systems operated by them is stored in a system only in India. They were also required to report compliance to RBI and submit a Board-approved System Audit Report conducted by a CERT-In impanelled auditor within the timelines specified therein.

According to the RBI's official statement, notwithstanding the lapse of considerable time and adequate opportunities being given, the entity has been found to be non-compliant with the directions on Storage of Payment System Data.

This order will not impact existing customers of Mastercard. Mastercard shall advise all card-issuing banks and non-banks to conform to these directions. The supervisory action has been taken in the exercise of powers vested in RBI under Section 17 of the Payment and Settlement Systems Act, 2007 (PSS Act), said RBI.

Read more news about Internet Advertising India, Marketing News, PR and Corporate Communication News, Digital Media News, Television Media News

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube, Whatsapp & Google News

Abby Awards: Anupama Ramaswamy, Ashish Chakravarty, Rajdeepak Das named Jury Chairs

The Abby Awards will be held on the 29th, 30th and 31st of May during Goafest 2024

Anupama Ramaswamy, Chief Creative Officer, Havas Worldwide India, Ashish Chakravarty, Executive Director, and India Head of Creative, for McCann Worldgroup and Rajdeepak Das, Chief Creative Officer Publicis Groupe, South Asia and Chairman, Leo Burnett, South Asia, join as Jury Chair for Still Digital category, Audio category, and Film (below 1 minute) category respectively, at The Abby Awards 2024 powered by One Show.

Anupama Ramaswamy, Chief Creative Officer, Havas Worldwide India has been appointed Jury Chair of Abby Awards 2024 powered by One Show in the Still Digital category.

Ashish Chakravarty Executive Director, and India Head of Creative, for McCann Worldgroup

has been appointed Jury Chair of Abby Awards 2024 powered by One Show in Audio category.

Rajdeepak Das, Chief Creative Officer Publicis Groupe, South Asia and Chairman, Leo Burnett, South Asia has been appointed Jury Chair of Abby Awards 2024 powered by One Show in Film (below 1 minute)category.

“I have always believed that an award is as good as its jury. This year too, the Abby Awards powered by One Show have a stellar line up of both domestic and international luminaries as Jury Chairs, across 23 categories. Over the last 2 years the number of women jurors have been significant, and this year, with over one-thirds being women masters of their craft. To win recognition from such respected Jury Chairs is a matter of immense pride for the AdClub, the participating agencies and brands.” said Ajay Kakar, Chairperson, Awards Governing Council, Abby Awards 2024 powered by One Show and Managing Committee Member, The Advertising Club.

The Abby Awards will be held on the 29th, 30th, and 31st of May during Goafest 2024.

Priyagold unveils new campaign featuring Kiara Advani for Snakker biscuits

The campaign aims to build a strong connection with the Gen Z audience

Priyagold has come up with a new campaign to create curiosity around the new range of Snakker biscuits among the Gen Z audience.

“With the launch of the new biscuit, the brand innovatively coined the term ‘Snakk’ to strike a chord with the youth. Resonating with their interest, Priyagold aspires to make Snakker biscuits synonymous to snacks. The video features brand ambassador Kiara Advani to tap the interest of youngsters. The popularity of the actress, coupled with her active social media presence bodes well for establishing a strong connection with the Gen Z audience,” the company said in a release.

Through the video posted on the celebrity’s social media platform, the brand created curiosity by showcasing the actress involved in baking a cake with secret ingredients. This keeps the audience hooked by compelling them to guess the favorite snack of the actress. Ultimately, the brand launched the roll-out of a video by Kiara Advani revealing the launch of the Snakker biscuit.

For driving mileage around the campaign, the brand also roped in relatable comedy influencers to amplify awareness. In the process, humor and wittiness were infused to the campaign to foster deeper connection with the audience.

Speaking on the occasion, Mannas Agarwwal, Priyagold's Director, said, "The campaign is designed to appeal to Gen-Z audience and that is why we incorporated the term “Snakk” for Snakker Biscuit which has two meanings, one means a Snack to have when hungry and other is referred to someone who is attractive or appealing. It is very important that we do ad campaigns which appeal to the younger demographic because they are becoming our largest consumer segment.”

International travel jitters? Alia & Ranveer show the way in MakeMyTrip’s new films

The two-film campaign is conceptualized by creative agency Moonshot

MakeMyTrip has launched two new brand films featuring brand ambassadors Alia Bhatt and Ranveer Singh. These films showcase the simplicity and convenience of booking flights and hotels for international travel with MakeMyTrip, catering to both first-time international travellers and seasoned travellers, the company said in a release.

There is a lot to consider when choosing flights and hotels for international travel, which often leaves travellers with decision fatigue or uncertainty. Whether it is a traveller’s first international trip or yet another one, the two new brand films pick up unlikely scenarios to deliver the message of convenience.

Raj Rishi Singh, Chief Marketing Officer & Chief Business Officer - Corporate, MakeMyTrip said, “We at MakeMyTrip believe in making the world more accessible, one trip at a time. In the past few months, we have introduced a suite of tools, features and benefits, some of them industry-firsts, designed for every international traveller, be it a first-timer or a seasoned globetrotter. Our aim is to ensure that everyone can partake in these benefits, making their travel booking and post-sales experience seamless and enjoyable. Our new films highlight the value addition we bring to the table, demonstrating how MakeMyTrip can be a game-changer when it comes to international bookings.”

The first film presents Alia and Ranveer as a newlywed couple on their wedding night, still trying to find their footing with each other. The conversation veers towards both sharing their apprehensions about their “first-time”. As film unfolds, viewers find out that the ‘first-time’ in question is in fact their first time travelling internationally. As a solution, they turn to MakeMyTrip for their flight and hotel bookings, both taking on the planning/research responsibility equally and with great enthusiasm.

In the second film, viewers are drawn into the middle of a suspenseful scene – where Ranveer Singh, playing an international spy/agent, unearths the location of a most wanted person. When Alia Bhatt, his commanding officer, discloses that the mission is in London, Ranveer, with his humorous style, argues that the criminal should be let go as ‘he isn’t bad at heart’ to save himself an international trip. Alia’s character senses his apprehensions and introduces him to the MakeMyTrip international booking experience, highlighting its ease and tension-free experience.

This campaign was conceptualized by the creative agency, Moonshot and films have been written by Devaiah Bopanna, Puneet Chadha and Deep Joshi.

HUL advertising spends jump 23% in Q4FY24

The FMCG giants posted a net profit of Rs 2561 crore in Q4, a decline of 1.54%

FMCG giant Hindustan Unilever has posted a consolidated net profit of Rs 2561 crore for the quarter ended March 31, 2024, declining by 1.54% from Rs 2601 crore in the same quarter last year. The company posted net profit of Rs 2508 crore for the quarter ended December, 2023.

The company spent Rs 1616 crore on advertising and promotions in Q4FY24. The expense saw a jump of 23.26%. The company spent Rs 1311 crore on advertising in Q4FY23. For the quarter ended December 2023, the company's advertising and promotion expenses stood at Rs 1626 crore.

HUL also announced a key change in its management committee. The company appointed BP Biddappa as Executive Director, Human Resources and Chief People, Transformation and Sustainability Officer for South Asia. Biddappa will also join the HUL Board as a Whole Time Director, subject to shareholder approval. Anuradha Razdan, currently Executive Director, Human Resources, HUL and Chief HR Officer, South Asia will be appointed to a global role as Chief Reward & Organization Development Officer for Unilever from June 1, 2024.

Welcoming Biddappa back to India, Rohit Jawa, CEO and Managing Director, HUL said, “An accomplished HR leader with over three decades of experience, Biddappa comes with immense knowledge of transformation and organizational development. I am glad to welcome him to the HUL Leadership and I am confident that his able guidance and leadership will help transform the business to progress further on our future-fit agenda.”

Thanking Anuradha for her contribution to the business, Rohit said, “Anuradha is known for her ability to shape and deliver a strategic business-focused people agenda. She has played a key role in the HUL Leadership Team over the past five years. Her appointment to a senior leadership role for Unilever is yet another testimony to the powerhouse of talent we have in India.”

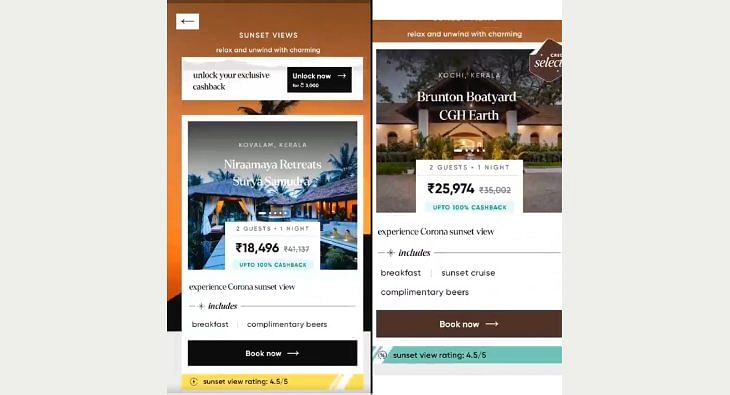

Can a sunset view be certified? Corona India has the answer

Conceptualized in partnership with Digitas India, part of Publicis Groupe India, the campaign enables luxury travellers to check out the sunset rating of iconic hotels

Corona India has launched a campaign to introduce its sunset view rating system for luxury hotel rooms. The system is now being piloted at a selection of luxury hotels including the CGH Brunton Boatyard, Niraamaya Surya Samudra and Brij Laxman Sagar located in Kochi, Kovalam and Pali respectively.

Corona’s unique campaign around stunning sunset views is set to capture every traveller’s heart. Conceptualized in partnership with Digitas India, part of Publicis Groupe India, the campaign enables luxury travellers to check out the sunset rating of iconic hotels across the country on CRED Escapes, a luxury travel platform for India’s 1%.

“With nearly 90% of people in cities spending their time indoors, the allure of sun tourism has been on the rise. Recognizing this trend, Corona India set out to create a unique solution—a sunset visual quality rating system akin to a Michelin Star for restaurants. This innovative approach guarantees travellers the opportunity to witness nature's wonder with certainty, transforming fleeting moments into cherished memories,” stated a press release.

“We all believe in taking a moment from our busy everyday lives to enjoy the beauty of sunsets. If a hotel room can guarantee impeccable service and a host of amenities, why can’t it promise a great sunset view? With The Corona Sunset View, we aim to forever reimagine how people experience sunsets - relaxing and unwinding with their friends and enjoying a cold Corona served with a lime,” said Vineet Sharma, Vice President Marketing & Trade Marketing, AB InBev India.

“We’ve all been to that one hotel where everything is perfect, and yet been disappointed with the sunset view after spending a considerable amount of time and money planning a holiday. The Corona Sunset View combines unique scientific data and predictive modelling to solve a real-world problem, ensuring that sunset seekers can enjoy their moments with certainty, and making Corona the reference point for the world’s most beautiful sunsets,” said Abraham Varughese, Chief Creative Officer, Digitas India.

Patanjali: A long history of controversial ads by the Baba Ramdev-owned company

The recent case is just one among many such controversial and politically incorrect ads by Patanjali

Listen to This Article

Homegrown brand Patanjali, owned by Ramdev Baba and Acharya Balkrishna, has been rapped again by the Supreme Court for the size of its “apology” which was reportedly smaller than its contentious ads.

It all started in July 2022 when the company printed a large ad for Patanjali Wellness, disparaging Western medicine titled “Misconceptions spread by allopathy: Save yourself and the country from the misconceptions spread by pharma and medical industry.”

Attack on allopathy

In an elaborate print ad, Patanjali raised concerns about the "side effects" of allopathic drugs and claimed that its own medicines were backed with scientific research by India's sages like Charak, Sushrut, Dhanvantri and the eponymous Patanjali.

Talking about lifestyle diseases such as BP, diabetes, thyroid, eye-and-ear diseases, arthritis and other incurable diseases, the company claimed to offer "permanent relief" from the ailments.

Terming his remarks a "criminal act" under IPC section 499, in May 2022, IMA sent a Rs 1,000 crore defamation notice to Patanjali, demanding that Baba Ramdev apologise.

It filed a petition in the Supreme Court over the disparaging ad in August 2022. The first hearing on the matter happened in November 2023, when Patanjali was warned against using terms like "permanent relief" under the 1954 act to sell its products.

In January, an anonymous letter notified the Chief Justice of India about Patanjali's continued violation of its assurance to the court.

After pulling up the errant company, SC asked Patanjali to issue a printed apology, the size of which is the current bone of contention between the apex court and the company.

Patanjali has a long and chequered history of misleading ads much before the 2022 print advertisement.

Coronil ad

The Ayurvedic brand first squared off with the litigant—in February of 2021 when the coronavirus pandemic was at its zenith.

The yoga guru released a scientific research paper on the “first evidence-based medicine for COVID-19”, brand name Coronil launched by Patanjali.

The company claimed that the Coronil tablet received a certification from the Ayush Ministry as a COVID-19 treatment support as per the World Health Organization’s (WHO) certification scheme.

IMA expressed its shock over the “blatant lie of WHO certification.” WHO later clarified that it did not review the effectiveness of any traditional medicine for coronavirus.

'Fairness' cream ad

Patanjali courted controversy in January 2018 over a beauty cream ad, which listed dark complexion as a skin ailement. The company blamed the snafu on a translation issue, stating that the term Patanjali approved was "Skin Complications."

Cooking oil ad

Patanjali is perhaps the only company to invoke patriotism to sell its cooking oil brands when in August 2017, it bizarrely claimed that all profits from the products go to charity. The company urged "all patriotic Indians" to buy its cooking oil and perform their "patriotic duties."

Goafest 2024 to explore 'The Age of Adaptability'

The event is scheduled to take place from May 29-31 in Mumbai

The Advertising Agencies Association of India (AAAI) and The Advertising Club have announced that the theme for Goafest 2024 will be ‘The Age of Adaptability’.

The event, scheduled to take place from May 29-31 in Mumbai aims to highlight the resilience and innovative spirit of the advertising and marketing industries in an era defined by rapid change.

"The theme for Goafest 2024, 'The Age Of Adaptability', was chosen to reflect the current ethos of our industry. Adaptability is at the core of what we do - from adjusting to new media platforms to adopting innovative marketing strategies," said Jaideep Gandhi, Chairperson of the Goafest Organising Committee. "This festival will not only celebrate creativity but also the ability to pivot and thrive amidst challenges."

“This year, at Goafest 2024, our central theme 'The Age of Adaptability' has a chameleon as a mascot. The chameleon is a creature known for its remarkable adaptive prowess. Like the chameleon, which adjusts its colors to match its environment, our industry too must continuously evolve its strategies and creative approaches to thrive in changing landscapes. This year’s festival will celebrate and cultivate the chameleon-like ability to adapt swiftly and effectively, ensuring our practices remain on the cutting-edge of creativity and relevance. The Age Of Adaptability concept has been created and designed by the young and very talented team at Abnormal Design Studios," said Rohit Ohri, Chairperson Goafest Content Committee.

Share

Share